The real estate market is dynamic and ever-changing, making house price prediction an essential tool for buyers, sellers, investors, and real estate professionals. Accurate predictions help stakeholders make informed decisions, whether buying a dream home or planning a profitable investment. In recent years, machine learning has emerged as a game-changer in this field, offering unprecedented accuracy and insights compared to traditional statistical methods.

Machine learning leverages vast amounts of data to uncover hidden patterns and trends, enabling precise forecasts of property values. According to a report by Grand View Research, the global machine learning market size was valued at $15.44 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 38.8% from 2022 to 2030. This highlights the increasing adoption of machine learning across industries, including real estate.

In this article, we’ll dive into the basics of house price prediction, explore the role of machine learning, and provide a step-by-step guide to building a predictive model. By the end, you’ll have a clear understanding of how these technologies can transform decision-making in real estate.

Understanding The Basics

What is House Price Prediction?

House price prediction is the process of estimating the potential selling price of a property based on various influencing factors. It’s a critical tool for buyers aiming to find affordable homes, sellers wanting competitive pricing, and investors seeking profitable opportunities.

Traditionally, this task relied on basic statistical methods, local expertise, and market trends. While these approaches were useful, they often lacked precision and scalability. With the advent of machine learning, however, predicting house prices has become more efficient and accurate.

Role of Machine Learning in Predictions

Machine learning (ML) uses algorithms to analyze complex datasets, identify patterns, and make predictions based on historical data. Unlike traditional methods, ML models can handle large datasets, accommodate non-linear relationships, and adapt to changing market trends.

For example:

- A Linear Regression model might analyze how factors like square footage, location, and number of bedrooms affect prices.

- A more advanced model like Random Forest can capture complex interactions between features, improving prediction accuracy.

Key Factors Influencing House Prices

1. Location

The property’s location significantly impacts its value. Proximity to amenities like schools, parks, public transportation, and business districts typically increases demand and price. Factors such as safety, climate, and scenic views also contribute.

2. Property Features

Key features include:

- Size: Larger homes often cost more.

- Age: Newer properties may fetch higher prices due to lower maintenance needs.

- Rooms: More bedrooms and bathrooms generally increase value.

- Quality: High-quality construction and modern designs add to the appeal.

3. Market Trends

Economic conditions like interest rates, inflation, and employment levels influence housing demand and prices. For example, low interest rates often lead to higher property values.

4. External Factors

Policies, natural disasters, or global events can affect housing prices, such as zoning laws or shifts in preferences during events like pandemics.

Data Collection and Preprocessing

1. Data Collection

Gather relevant data such as:

- Historical Sales Data: Past prices and transaction details.

- Property Attributes: Size, location, age, and number of rooms.

- Economic Indicators: Interest rates, inflation, and employment stats.

- Geographical Data: Proximity to amenities and crime rates.

2. Data Cleaning

- Handle missing values (e.g., fill or remove incomplete data).

- Remove outliers that skew results.

- Standardize formats for consistency.

3. Data Normalization

Scale numerical values (e.g., property size) to ensure all features contribute equally to the model.

4. Feature Encoding

Convert categorical data (e.g., neighborhoods) into numerical formats using techniques like One-Hot Encoding.

5. Data Splitting

Divide data into:

- Training Set: For model training.

- Test Set: For performance evaluation.

Exploratory Data Analysis (EDA)

Exploratory Data Analysis (EDA) helps understand the dataset and uncover patterns and relationships that influence house prices. Here’s a concise breakdown of EDA steps:

1. Understand Data Distribution

Use statistical methods and visualizations like histograms and box plots to explore:

- Price distribution (e.g., skewness or outliers).

- Key property features (e.g., average size, number of rooms).

2. Identify Patterns and Trends

Analyze relationships between variables using scatter plots, bar charts, or line graphs. For example:

- How property size correlates with price.

- Trends in house prices over time.

3. Feature Correlation

Calculate correlation coefficients to identify features strongly linked to house prices. Heatmaps help visualize these relationships, highlighting the most influential factors.

4. Detect Outliers

Spot unusually high or low prices and decide whether to include or exclude them, as they might affect model accuracy.

5. Address Missing Data

Revisit missing values and determine if they can be filled with averages, medians, or more advanced techniques, depending on their significance.

Feature Engineering

Feature engineering involves refining the dataset to improve the performance of machine learning models. It ensures the model focuses on the most relevant and impactful data.

1. Selecting Relevant Features

Identify and retain features that have the strongest correlation with house prices. For instance:

- Property size, location, and age often have a significant impact.

- Drop irrelevant or redundant features, like unique IDs or unrelated timestamps.

2. Creating New Features

Generate new variables from existing data to improve the model’s predictive power. Examples include:

- Price per Square Foot: Calculated as price divided by size, providing a standardized view of value.

- Distance to Amenities: Proximity to schools, parks, or transportation hubs.

3. Handling Categorical Features

Convert categorical data into numerical values using:

- One-Hot Encoding: Creates binary columns for each category (e.g., neighborhood types).

- Label Encoding: Assigns numerical labels to categories.

4. Feature Scaling

Standardize numerical features to ensure consistency, especially when using algorithms sensitive to scale, like Gradient Boosting or Neural Networks.

5. Dimensionality Reduction (Optional)

For datasets with many features, techniques like Principal Component Analysis (PCA) can reduce complexity while retaining essential information.

Choosing the Right Machine Learning Model

Selecting the appropriate machine learning model is critical for achieving accurate house price predictions. Here’s an overview of commonly used models and their applications:

1. Linear Regression

- Use Case: Best for datasets where relationships between variables are linear.

- Advantages: Simple, interpretable, and efficient for smaller datasets.

- Limitations: Struggles with non-linear relationships and complex datasets.

2. Decision Trees

- Use Case: Suitable for capturing non-linear relationships and handling categorical data.

- Advantages: Easy to interpret and visualize.

- Limitations: Prone to overfitting if not pruned.

3. Random Forest

- Use Case: Works well for large datasets with mixed data types.

- Advantages: Reduces overfitting by combining multiple decision trees, offering higher accuracy.

- Limitations: Computationally intensive for very large datasets.

4. Gradient Boosting (e.g., XGBoost, LightGBM)

- Use Case: Ideal for optimizing performance in competitive scenarios.

- Advantages: Highly accurate, effective for complex relationships, and handles missing data well.

- Limitations: Requires careful tuning to prevent overfitting.

5. Neural Networks

- Use Case: Best for very large datasets and highly complex patterns.

- Advantages: Can model intricate relationships and interactions.

- Limitations: Requires extensive data and computational resources; harder to interpret.

Model Selection Criteria

When choosing a model, consider:

- Accuracy: How well does it predict unseen data?

- Interpretability: Is the model easy to understand and explain?

- Efficiency: Does it perform well within computational limits?

- Scalability: Can it handle larger datasets?

Model Training and Evaluation

1. Model Training

- Split the data into:

- Training Set (70–80%): For learning patterns.

- Test Set (20–30%): For performance evaluation.

- Train the selected model (e.g., Random Forest, XGBoost) using the training set.

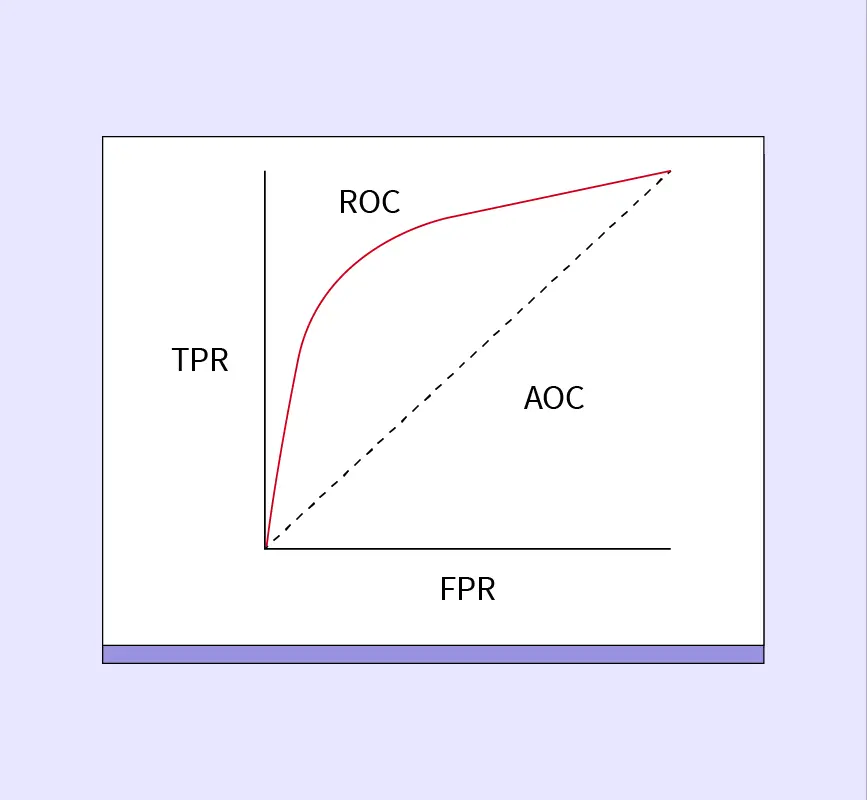

2. Model Evaluation Metrics

- Mean Squared Error (MSE): Measures average squared prediction error. Lower is better.

- Root Mean Squared Error (RMSE): Square root of MSE, showing error in price units.

- R-squared (R2R^2R2): Proportion of variance explained by the model; closer to 1 is better.

3. Cross-Validation

Use k-fold cross-validation to validate model performance on different data splits and prevent overfitting.

4. Hyperparameter Tuning

Optimize the model using:

- Grid Search: Testing all parameter combinations.

- Random Search: Sampling random parameter combinations.

Handling Overfitting and Underfitting

To build an effective predictive model, it’s crucial to balance overfitting and underfitting:

1. What is Overfitting?

- Overfitting occurs when the model learns noise and details specific to the training data, resulting in poor performance on new data.

- Symptoms: High accuracy on training data but low accuracy on test data.

2. What is Underfitting?

- Underfitting happens when the model fails to capture the underlying patterns in the data.

- Symptoms: Low accuracy on both training and test data.

3. Techniques to Prevent Overfitting

- Cross-Validation: Use k-fold cross-validation to test the model on multiple data subsets.

- Regularization: Add penalties to complex models using techniques like L1 (Lasso) or L2 (Ridge) regularization.

- Pruning: Simplify decision trees by removing branches that add little value.

- Reduce Complexity: Limit the depth of trees or the number of features.

4. Techniques to Prevent Underfitting

- Feature Engineering: Include more relevant features or create new ones.

- Model Complexity: Use more advanced algorithms capable of capturing complex patterns (e.g., Random Forest or Gradient Boosting).

- Training Duration: Ensure the model trains for an adequate number of iterations.

Model Deployment

Deploying the trained machine learning model allows it to make real-world predictions and provide value to users. Here’s how to approach it:

1. Preparing the Model for Deployment

- Save the Model: Export the trained model using libraries like joblib or pickle in Python.

- Optimize Performance: Reduce model size and improve response time using techniques like model compression or optimized libraries (e.g., TensorFlow Lite).

2. Creating an API

- Build a RESTful API to interact with the model. Popular frameworks include:

- Flask or FastAPI (Python): For creating lightweight APIs.

- Django: For more complex applications with built-in tools.

- Example: Send property details to the API and receive a predicted price.

3. Integration with Applications

- Web Applications: Embed predictions into user-friendly interfaces for real estate platforms.

- Mobile Apps: Provide on-the-go price estimates for users.

- Dashboards: Enable stakeholders to analyze predictions alongside market trends.

4. Monitoring and Updating the Model

- Monitor predictions regularly to ensure accuracy.

- Update the model with new data to adapt to market changes.

Case Study: Predicting House Prices with Machine Learning

1. Dataset Overview

For this case study, we’ll use the California Housing Dataset, a popular dataset containing property details like location, median income, number of rooms, and house prices. This dataset is ideal for building a predictive model due to its simplicity and rich features.

2. Step-by-Step Implementation

Step 1: Import Libraries and Load Data Using Python, load the dataset and essential libraries:

Step 2: Data Preprocessing Clean and prepare the data:

- Handle missing values and remove outliers.

- Normalize features like income or property size.

- Split the data into training (80%) and test (20%) sets:

Step 3: Train the Model Choose a model (e.g., Random Forest) and train it:

Step 4: Evaluate the Model Measure model performance using RMSE and R-squared:

Step 5: Deployment Save the model and integrate it into an application:

3. Observations

- RMSE: A lower RMSE indicates accurate predictions.

- R-squared: Values close to 1 suggest the model explains most of the variance in house prices.

4. Lessons Learned

- Feature Importance: Insights into which factors (e.g., location, income) impact prices the most.

Challenges: Addressing outliers and ensuring data quality significantly affects performance.

In-depth Python Code for House Price Prediction

Step 1: Import Necessary Libraries

# Import libraries

import pandas as pd

import numpy as np

from sklearn.model_selection import train_test_split

from sklearn.ensemble import RandomForestRegressor

from sklearn.metrics import mean_squared_error, r2_score

import seaborn as sns

import matplotlib.pyplot as pltStep 2: Load and Explore the Dataset

Use a sample dataset like the California Housing Dataset or upload your dataset.

# Load the dataset (example: California housing dataset)

data = pd.read_csv("california_housing_data.csv")

# Display the first few rows

data.head()Simulated Output:

| Longitude | Latitude | Housing Median Age | Total Rooms | Total Bedrooms | Median Income | Median House Value |

|---|---|---|---|---|---|---|

| -122.23 | 37.88 | 41 | 880 | 129 | 8.3252 | 452600 |

| -122.22 | 37.86 | 21 | 7099 | 1106 | 8.3014 | 358500 |

Step 3: Data Preprocessing

# Check for missing values

data.isnull().sum()

# Handle missing values (if any)

data = data.dropna()

# Feature-target split

X = data.drop('Median House Value', axis=1) # Features

y = data['Median House Value'] # Target

# Split the dataset into training and testing sets

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=42)Step 4: Exploratory Data Analysis (EDA)

# Visualize correlation

plt.figure(figsize=(10, 8))

sns.heatmap(data.corr(), annot=True, cmap='coolwarm')

plt.title("Feature Correlation with House Prices")

plt.show()Simulated Output:

- A heatmap showing strong correlations between Median Income and Median House Value.

Step 5: Train the Machine Learning Model

# Initialize and train the Random Forest Regressor

model = RandomForestRegressor(n_estimators=100, random_state=42)

model.fit(X_train, y_train)

# Make predictions on the test set

y_pred = model.predict(X_test)Step 6: Evaluate Model Performance

# Calculate evaluation metrics

rmse = mean_squared_error(y_test, y_pred, squared=False)

r2 = r2_score(y_test, y_pred)

print(f"Root Mean Squared Error (RMSE): {rmse}")

print(f"R-squared (R2): {r2}")Simulated Output:

Root Mean Squared Error (RMSE): 45632.45

R-squared (R2): 0.87Step 7: Feature Importance Analysis

# Visualize feature importance

importance = model.feature_importances_

feature_names = X.columns

# Plot feature importance

plt.figure(figsize=(10, 6))

plt.barh(feature_names, importance)

plt.title("Feature Importance")

plt.xlabel("Importance Score")

plt.ylabel("Features")

plt.show()Simulated Output:

- Median Income shows the highest importance, followed by Total Rooms.

Step 8: Save the Model

import joblib

# Save the trained model

joblib.dump(model, 'house_price_model.pkl')

print("Model saved as house_price_model.pkl")Step 9: Deploy the Model (Example with Flask)

from flask import Flask, request, jsonify

import joblib

# Load the model

loaded_model = joblib.load('house_price_model.pkl')

# Initialize Flask app

app = Flask(__name__)

@app.route('/predict', methods=['POST'])

def predict():

# Get data from request

data = request.get_json()

features = np.array(data['features']).reshape(1, -1)

# Make prediction

prediction = loaded_model.predict(features)

return jsonify({'predicted_price': prediction[0]})

if __name__ == '__main__':

app.run(debug=True)Step 10: Testing the API

Use a tool like Postman or cURL to test the API:

curl -X POST -H "Content-Type: application/json" -d '{"features": [37.88, -122.23, 41, 880, 129, 8.3252]}' http://127.0.0.1:5000/predictSimulated API Response:

{

"predicted_price": 450320.5

}This step-by-step implementation provides a comprehensive workflow, from loading data to deploying the model. Let me know if you’d like further refinements or additional functionality!

Challenges and Considerations

While machine learning enhances house price prediction, it comes with challenges:

- Data Quality: Missing or outdated data can compromise accuracy.

- Model Interpretability: Complex models (e.g., Neural Networks) may lack transparency, complicating trust and adoption.

- Market Dynamics: Rapid market changes require frequent model retraining to remain relevant.

Future Trends in House Price Prediction

- Advanced Algorithms: Emerging techniques like deep learning and ensemble models can improve accuracy further.

- Big Data and IoT: Integrating IoT data (e.g., smart home devices) and big data analytics could provide richer insights.

- Real-Time Predictions: Cloud-based solutions enable instant, real-time house price predictions.

Conclusion

Predicting house prices with machine learning revolutionizes the real estate market by providing data-driven insights and accurate valuations. From understanding key factors to deploying a model, this article provides a complete guide for beginners to dive into this exciting field. Machine learning not only empowers stakeholders to make informed decisions but also sets the stage for future innovations in real estate analytics.