Artificial Intelligence (AI) is transforming industries globally, and banking is no exception. From enhancing customer experiences to automating processes, AI is driving digital transformation in financial services. Its ability to analyze large datasets and offer predictive insights makes it a cornerstone for innovation in the banking sector.

What is AI in Banking?

Artificial Intelligence (AI) in banking refers to the integration of advanced computational technologies to enhance, automate, and streamline financial operations. It encompasses tools and techniques like machine learning (ML), natural language processing (NLP), and robotic process automation (RPA) to improve efficiency and decision-making.

AI is transforming traditional banking processes by enabling systems to learn and adapt based on data patterns. Machine learning models are commonly used to detect fraud, analyze creditworthiness, and forecast market trends. NLP powers chatbots and virtual assistants, facilitating seamless customer interactions by addressing queries, providing support, and executing simple transactions.

Prominent examples include AI-powered chatbots like Bank of America’s Erica, which assists customers with account queries and expense tracking. Fraud detection systems utilize ML algorithms to identify anomalies in transaction patterns, safeguarding assets and preventing losses.

Through predictive analytics, AI enhances risk management by assessing market fluctuations and customer behaviors. It also enables hyper-personalization, such as recommending tailored financial products or services. As a result, AI plays a pivotal role in reshaping how banks interact with customers, handle data, and maintain operational security in a rapidly evolving financial landscape.

The Rise of AI in Banking

Evolution of AI in Banking

The banking sector has undergone a remarkable transition from traditional, branch-centric operations to digital-first approaches powered by Artificial Intelligence (AI). Early adoption focused on simple automation tools to streamline tasks like account management and transaction processing. However, the emergence of advanced AI technologies has revolutionized the industry, enabling smarter, more efficient banking services.

Milestones in AI adoption include the deployment of machine learning models for credit risk analysis in the 2000s and the introduction of chatbots for customer support in the 2010s. Today, AI influences every aspect of banking, from fraud detection to personalized financial recommendations, reflecting a continuous evolution toward data-driven decision-making.

Current Trends in AI Adoption

The rapid growth of fintech and startup ecosystems has significantly accelerated AI innovation in banking. Fintech companies leverage AI to deliver seamless digital payment systems, peer-to-peer lending platforms, and blockchain-based solutions. Traditional banks are collaborating with these agile firms to modernize their services and stay competitive.

Banks are also increasing their investments in AI-driven solutions such as predictive analytics for customer insights, biometric authentication for security, and robotic process automation (RPA) for operational efficiency. These trends demonstrate AI’s expanding influence, as it becomes indispensable for transforming banking into a smarter, more customer-centric industry.

Why AI Matters to Financial Services

Artificial Intelligence (AI) is revolutionizing financial services by enhancing customer experience, optimizing operations, and mitigating risks. Its impact extends across all areas of banking, making it a cornerstone of the industry’s transformation.

Enhancing Customer Experience

AI empowers financial institutions to deliver personalized experiences through tailored services. By analyzing customer behavior and preferences, AI-driven systems recommend customized financial products, such as loans or investment plans. Chatbots and virtual assistants provide 24/7 support, resolving queries instantly and elevating customer satisfaction.

Improving Efficiency

Process automation through AI has streamlined back-office operations, significantly reducing human error and saving time. Tasks like loan processing, document verification, and compliance reporting are now completed in minutes instead of days. Robotic Process Automation (RPA) further optimizes workflows, allowing staff to focus on higher-value activities.

Strengthening Security

AI plays a critical role in fortifying security and risk management. Machine learning algorithms detect anomalies in real-time, flagging fraudulent transactions and unauthorized access attempts. Advanced systems like biometric authentication enhance account security, offering robust safeguards against cyber threats.

Increasing Accessibility

AI has bridged gaps for underserved populations by enabling digital-first banking solutions. From offering microloans to automating financial literacy tools, AI is making banking more inclusive, fostering economic growth in remote and underserved areas.

Applications of AI in Banking

Artificial Intelligence (AI) has become a transformative force in the banking industry, offering innovative solutions to enhance efficiency, improve security, and deliver personalized services. Key applications of AI in banking include:

1. Fraud Detection and Prevention

AI tools are indispensable for identifying unusual patterns in transactions, helping banks combat fraud effectively. Advanced machine learning algorithms analyze massive datasets in real-time to detect anomalies that might indicate fraudulent activity. For example, AI systems can flag suspicious transactions, such as unusual login attempts or significant transfers, alerting banks and customers immediately. These real-time fraud detection systems minimize financial losses and protect customer trust.

2. Personalized Customer Experiences

AI enables banks to deliver highly personalized customer interactions. AI-powered chatbots and virtual assistants provide instant support, answering common questions, resolving issues, and even offering financial advice. Additionally, AI analyzes customer behavior to recommend customized financial products like savings plans or investment opportunities, creating a tailored banking experience that boosts customer loyalty.

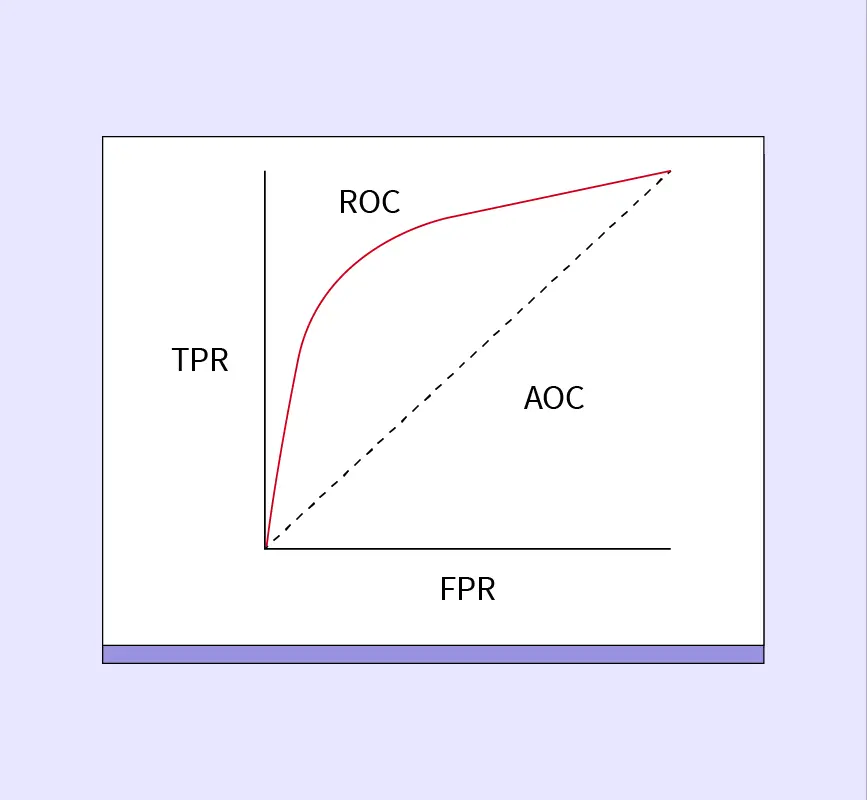

3. Credit Scoring and Risk Assessment

AI plays a critical role in evaluating creditworthiness. By analyzing data from various sources—such as transaction history, employment records, and social media activity—AI models provide faster and more accurate credit scoring. This enables quicker loan approvals and ensures banks can assess risk more effectively, reducing default rates and enhancing customer satisfaction.

4. Process Automation

AI streamlines back-office operations by automating repetitive tasks. From document verification to compliance checks, AI ensures faster, error-free processes, significantly reducing operational costs. For instance, robotic process automation (RPA) has enabled banks to handle massive volumes of paperwork and regulatory requirements in a fraction of the time it would take manually.

5. Trading and Wealth Management

AI has revolutionized trading and wealth management by introducing sophisticated algorithms that analyze market trends and execute trades autonomously. Portfolio management has also benefited, with AI-driven tools providing insights into asset allocation and investment strategies. Robo-advisors, powered by AI, offer retail investors affordable, data-driven advice, making wealth management accessible to a broader audience.

AI applications in banking are continuously evolving, driving innovation and enabling institutions to meet modern financial challenges effectively. These tools not only enhance operational efficiency but also improve customer trust and satisfaction by delivering secure, intelligent, and personalized banking experiences.

Challenges of AI in Banking

While Artificial Intelligence (AI) has revolutionized the banking sector, its implementation comes with significant challenges. Banks must navigate these obstacles to harness AI’s full potential effectively.

1. Data Privacy and Security Concerns

AI systems in banking rely on processing vast amounts of sensitive customer data, making data privacy a critical issue. Protecting personal and financial information from cyberattacks and breaches is paramount. Cybersecurity threats, such as hacking or data leaks, pose significant risks, potentially eroding customer trust. Ensuring compliance with data protection laws like GDPR and local privacy regulations is an ongoing challenge.

2. Ethical Considerations and Bias

AI-driven decisions in banking, such as credit approvals and loan assessments, may unintentionally reflect biases present in training data. This could lead to discriminatory practices that disadvantage certain demographic groups. Maintaining transparency and accountability in AI processes is crucial to addressing these biases. Banks must also implement mechanisms to explain AI decisions, fostering trust and fairness.

3. Cost of Implementation

Adopting AI technologies requires substantial investment in infrastructure, software, and skilled personnel. For many banks, particularly smaller institutions, the cost of implementing AI can be prohibitive. Moreover, integrating AI systems with existing legacy infrastructure can be complex and time-consuming, requiring technical expertise and strategic planning.

4. Regulatory and Compliance Issues

The rapidly evolving landscape of AI regulations presents another significant challenge. Banks must stay updated with national and international guidelines on AI usage, including transparency, fairness, and accountability requirements. Global differences in regulatory frameworks further complicate compliance, particularly for multinational banks operating across diverse jurisdictions.

The Future of AI in Banking

The future of Artificial Intelligence (AI) in banking is poised to redefine the industry with innovations that enhance efficiency, security, and customer experience. As AI continues to evolve, it will play a pivotal role in driving open banking and decentralized finance (DeFi).

Predictions for AI-Driven Innovations

AI is expected to power hyper-personalized banking experiences, leveraging advanced data analytics to predict customer needs and offer tailored financial solutions. Real-time fraud detection and prevention systems will become more sophisticated, ensuring secure transactions in an increasingly digital-first world. Additionally, AI’s integration into blockchain technology could revolutionize secure payment systems and streamline cross-border transactions.

Expansion in Open Banking and DeFi

AI will accelerate the adoption of open banking, enabling seamless sharing of financial data across institutions for improved customer experiences. In decentralized finance, AI algorithms will support automated financial services like lending and trading, reducing reliance on intermediaries and promoting financial inclusion.

Encouraging Partnerships

Collaboration between banks and technology companies will be key to future advancements. Partnerships with fintech startups and AI solution providers will foster innovation, allowing traditional banks to stay competitive in the fast-paced financial ecosystem.

Conclusion

Artificial Intelligence (AI) has emerged as a transformative force in banking, revolutionizing customer experiences, enhancing operational efficiency, and strengthening security measures. As banks continue to adopt AI-driven solutions, the potential for innovation and growth is immense. However, responsible implementation, focusing on transparency, ethical practices, and robust data security, remains crucial to addressing the challenges associated with AI. By strategically leveraging AI technologies, banks can stay ahead in the competitive financial landscape. Ultimately, AI serves as a catalyst, shaping the future of banking into a more inclusive, efficient, and customer-centric industry.

References: